Term Insurance Vs Medical Insurance – Which One to Choose?

Many people mix up term insurance and health insurance, thinking one can replace the other. However, both serve different purposes. Term insurance protects your family financially if you pass away, while health insurance covers your medical expenses. Let’s cover the difference between term insurance ...read more

What is Health Insurance?

Health insurance is a general insurance policy that helps pay for your medical expenses, like doctor visits, hospital stays, surgeries, and sometimes medicines. In the UAE, it is mandatory to have a health insurance policy. You pay a monthly fee, and the insurance company covers part or all of your treatment costs.

Types of Health Insurance Plans

- Basic Health Insurance Plan: The most affordable option that covers only essential services like general doctor visits, emergencies, and limited hospital care.

- Semi-Comprehensive Health Insurance Plan: Offers wider coverage, including maternity, specialist access, and treatment for some chronic conditions, while still being cost-effective.

- Comprehensive Health Insurance Plan: Provides the highest coverage, including dental, optical, mental health, and international care, with direct access to top hospitals and specialists.

What is Term Insurance?

Term insurance in the UAE is a life insurance plan that provides coverage for a fixed period and pays a lump sum to your family if you pass away during this time. You have the flexibility to choose your coverage amount and policy term.

Types of Term Insurance Plans

- Level Term Plan: Same sum assured throughout the policy.

- Convertible Term Plan: Change to another life insurance type later.

- Increasing Term Plan: Cover increases every year, premium stays the same.

- Decreasing Term Plan: Cover decreases over time, useful for loans.

Read more about: Term Insurance in UAE

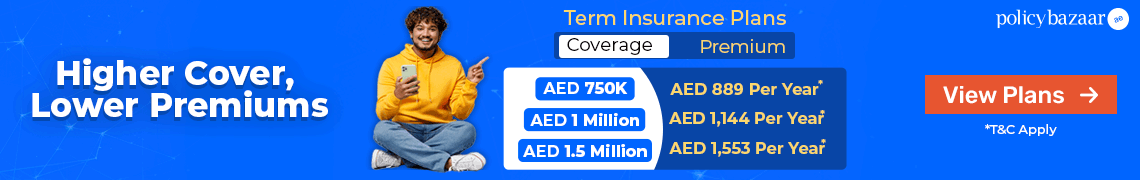

Best Term Insurance Plans in UAE

Some of the best Term Insurance quotes in UAE & Dubai are:

Term Insurance vs Health Insurance – Quick Comparison

The difference between health insurance and term insurance lies in when and how they protect you —

|

Basis |

Health Insurance |

Term Insurance |

|---|---|---|

|

Purpose |

Pays for medical expenses due to illness, injury, or hospitalisation |

Provides a lump-sum payout to your family if you pass away during the policy term |

|

Objective |

Reduces the burden of high hospital and treatment costs |

Ensures your dependents have financial support after your death |

|

Coverage |

Hospitalisation, treatments, medicines, surgeries, diagnostics, sometimes maternity and critical illness |

Lump-sum death benefit; riders for accidental death or critical illness |

|

Payout |

Paid to you (or directly to hospital) when you claim for treatment |

Paid to nominee after your death during the policy term |

|

Premium Amount |

Higher, especially with age, due to broad medical coverage |

Low and affordable for large cover amounts |

|

Payment Mode |

Yearly, half-yearly, quarterly, or monthly |

Yearly, half-yearly, quarterly, or monthly |

|

Rider Benefits |

Maternity cover, wellness programs, worldwide treatment |

Waiver of premium, accidental death benefit,permanent disability cover, critical illness cover |

|

Renewal Benefits |

No-Claim Bonus (NCB) increases sum insured or reduces premium if no claim is made |

No renewal benefits; fixed premium for the term |

Benefits of Health Insurance vs Term Insurance

Both term insurance and health insurance are essential for protecting your family’s financial well-being, but they work in very different ways.

Here’s a breakdown of their key benefits with examples so you can picture how they help in real life —

Benefits of Health Insurance Plans

- Pre & Post-Hospitalisation Cover: Pays for tests, scans, and medicines before admission and after discharge.

- Accident Cover: If you add personal accident cover, your treatment for accident injuries is also paid for.

- Maternity Cover: Many plans include coverage for maternity care and also cover newborn babies for the first 30 days.

- Cashless Hospitalisation: Get treated at network hospitals without paying upfront; the insurer settles directly with the hospital.

Benefits of Term Insurance Plans

- High Cover at Low Cost: Large protection amounts for small premiums.

- Payout Option: Your family can receive the benefit as a lump sum payout.

- Easy to Understand & Buy: Simple life cover without investment components, easily purchasable online.

- Flexible Premium Payment: Pay annually, monthly, or as a one-time lump sum depending on your budget.

- Coverage Period Choice: Select terms from 5 to 35 years to match your needs (e.g., until kids finish education).

- Optional Riders for Extra Protection: Add-ons like critical illness, accidental death, waiver of premium, and disability cover.

Term Insurance vs Medical Insurance: Which One Should You Choose?

It’s not health insurance vs term insurance, it’s term insurance and health insurance. Both are important:

- Health insurance keeps your savings safe when you need medical treatment.

- Term insurance ensures your family can manage expenses if you’re not around.

The smart choice is to have both so that you’re covered in life’s two biggest financial risks, medical emergencies and loss of income due to death.

Bottom Line

The difference between term and health insurance is clear: health insurance takes care of you while you’re alive; term insurance takes care of your loved ones when you’re gone. Together, they form a complete safety net for your life and finances.

If you are looking for the right cover for yourself, Policybazaar.ae will help you compare top plans, check prices instantly, and secure your health in minutes, all in one place.

FAQs for Term Insurance vs Medical Insurance

Is term insurance better than health insurance?

Both types are equally important. Term insurance supports your family financially if you pass away. Health insurance pays for your medical expenses during illnesses or accidents.

Can we take term insurance and health insurance together?

Term insurance and health insurance work hand-in-hand; one protects your family’s future income, the other covers medical costs.

Do I need both health and life insurance?

Yes. Health insurance shields you from high hospital bills, and life insurance secures your family’s finances if you’re no longer around.

Is medical insurance mandatory in the UAE?

Yes. It’s required for UAE residency permits, and authorities like the ICP ensure workers are covered before issuing or renewing visas.

Everything You Need to Know About Life Insurance

Other Insurance Products

Car Insurance Online | How to Check Car Insurance Status Online | Car Insurance Abu Dhabi | Health Insurance UAE | Best Medical Insurance In UAE | Schengen Travel insurance | Maternity Health Insurance | Top Health insurance Companies in UAE | Travel Insurance Dubai | Travel Insurance Online

More From Term Insurance

- Recent Articles

- Popular Articles

.jpg)