- Critical Illness Policy in Dubai

- Why Must One Buy Critical Illness Insurance?

- How does Critical Illness Policy Work?

- Who should buy a Critical Illness Cover in the UAE?

- Best Critical Illness Insurance Plans

- Key Features & Benefits of Critical Illness Policies in the UAE

- Critical Illness Plans - Inclusions & Exclusions

- Eligibility Criteria for Critical Illness

- Documents Required

- How to Buy Critical Illness Plans?

- How Much Does Critical Illness Insurance Coverage Cost In The UAE?

- What Factors Affect Critical Illness Premiums?

- How Much Cover Will I Need?

- Frequently Asked Questions (FAQs)

Critical Illness Insurance - A Complete Guide

Buy Critical Illness Insurance Plans In UAE

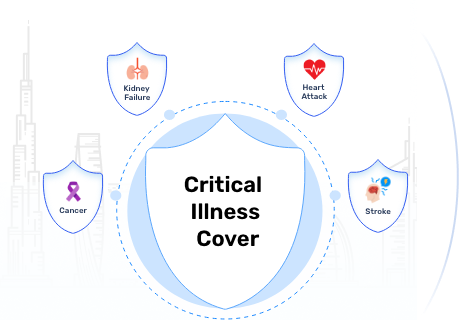

Critical illness insurance, also known as critical illness cover, offers a lump sum payment upon diagnosis of specific illnesses like heart disease, stroke, and chronic kidney disease—conditions that rank among the leading causes of death in the UAE.

Considering these statistics, it's clear that critical illness insurance is an essential consideration for UAE residents, providing financial security and peace of mind in times of health crisis.

Critical Illness Policy in Dubai

With a comprehensive scope, this insurance encompasses over 36 critical illnesses, ranging from cancer and Alzheimer’s to heart attacks, liver failure, and kidney failure. Additionally, coverage extends to major medical procedures such as organ transplants, open-heart surgery, and treatment for third-degree burns.

However, it's important to note that the specific list of covered illnesses may vary between insurance providers. Therefore, consulting with an insurance advisor is recommended to gain clarity on the exact diseases included in your policy.

Why Must One Buy Critical Illness Insurance?

Despite the growing popularity of term and health insurance, critical illness insurance remains overlooked due to lack of awareness and misconceptions about its necessity and cost.

However, critical illness insurance can be a lifesaver for those diagnosed with serious illnesses, offering a substantial lump sum benefit. It serves as a vital financial safety net, ensuring access to quality care without imposing excessive financial strain.

How does Critical Illness Policy Work?

Critical illness insurance operates as a vital safety net for individuals facing severe, long-term illnesses necessitating specialised and costly medical interventions. Upon diagnosis of a predetermined critical disease, policyholders become eligible to receive a substantial lump sum payment, typically after a standard multi-day grace period.

Who should buy a Critical Illness Cover in the UAE?

A critical illness cover becomes valid for:

Individuals with Dependents: Those who have dependents relying on their income should consider critical illness cover to ensure financial stability for their loved ones if they were to fall critically ill.

High-Risk Occupations: Individuals in high-risk professions or industries, where the likelihood of suffering a critical illness is elevated, may find critical illness cover particularly beneficial.

Limited Savings: For individuals with limited savings or financial resources, critical illness cover provides a safety net to cover medical expenses and maintain their standard of living during illness.

No Employer Coverage: If your employer does not provide comprehensive critical illness coverage or if you're self-employed, purchasing individual critical illness cover can safeguard against unforeseen medical expenses.

Peace of Mind: Anyone seeking peace of mind knowing that they have financial protection in place to handle the expenses associated with a critical illness should consider purchasing critical illness cover.

Best Critical Illness Insurance Plans

Here’s the list of the best critical illness insurance plans in the UAE -

Arabia Critical Illness Basic

|

Arabia Insurance Critical Illness Plus

|

Zurich Critical Illness Protection

|

Arabia Insurance Critical Illness Premium

|

Sukoon Insurance DIGI Critical Illness

|

Key Features & Benefits of Critical Illness Policies in the UAE

Here are a few general features of having a critical illness plan:

- Wide Coverage: Provides coverage for critical illnesses, including common ailments like heart attack and cancer.

- Global Coverage: Policy offers continuous protection, valid globally 24 hours a day (may vary from provider to provider).

- Comprehensive Benefits: The policyholder family receives a lump sum amount upon diagnosis. This amount can be used to settle debts, cover treatments, maintain lifestyle, and so on.

Critical Illness Plans - Inclusions & Exclusions

The general exclusions and inclusions of a critical illness plan in the UAE include:

|

Exclusions |

Inclusions |

|

Injuries from sports or self-inflicted injuries |

Coverage for critical conditions, including heart attack, stroke, cancer, and kidney failure |

|

Critical illnesses due to substance abuse |

Lump sum benefit for treatment expenses and loss of income |

|

Congenital disorders or birth defects |

30-day processing time for claims, subject to policy terms and conditions |

Eligibility Criteria for Critical Illness

Critical illness insurance is usually accessible to individuals aged 18 to 60 years, possessing a valid UAE residence visa.

Note that some critical illness insurance plans may have specific requirements with respect to residency. To avoid any hassle later, make sure to check the policy documents or talk to your insurance provider.

Documents Required

The general set of documents required for critical illness plans include:

- Visa Copy

- Passport copy

- Emirates ID copy

Note: You may be required to present certain other documents at the sole discretion of your chosen provider.

How to Buy Critical Illness Plans?

Here are the steps to consider before purchasing critical illness plans:

- Assess Coverage: Understand what critical illnesses are covered by the plan. Different providers may have varying lists of covered conditions, so it's essential to ensure the plan aligns with your needs.

- Evaluate Waiting Period: Determine the waiting period before the coverage becomes effective after purchasing the plan. Some policies may have a waiting period before certain benefits can be claimed.

- Compare Premium Rates: Compare the premium rates offered by different insurance providers for similar coverage. Consider factors such as your budget and the level of coverage offered to make an informed decision.

- Review Coverage Details: Dive into the specifics of the coverage, including the maximum benefit amount and any additional benefits or riders available. Understanding the scope of coverage helps in making a comprehensive decision.

- Understand the Renewal Process: Familiarize yourself with the renewal process, including renewal terms, conditions, and any potential changes in premium rates or coverage. This ensures continuous coverage without interruptions.

By following these steps, you can make an informed decision when purchasing a critical illness plan that best suits your needs and financial situation.

How Much Does Critical Illness Insurance Coverage Cost In The UAE?

On an average, critical illness insurance in the UAE ranges from AED 200 to AED 2500. The specific cost varies based on factors such as your chosen insurance provider and the sum insured, which typically falls between AED 200,000 to AED 500,000.

What Factors Affect Critical Illness Premiums?

Factors that influence critical illness insurance premiums include:

- Age and Health: Older individuals or those with pre-existing health conditions may face higher premiums due to a potentially higher risk of developing critical illnesses.

- Coverage Amount: The higher the sum insured, the higher the premium. This reflects the increased financial protection provided by the policy.

- Policy Features: Additional benefits or riders, such as coverage for specific critical illnesses or enhanced payout options, can impact premiums.

- Smoking Habits: Tobacco users typically face higher premiums due to the increased risk of critical illnesses associated with smoking.

- Occupation and Lifestyle: High-risk occupations or lifestyles, such as those involving hazardous activities or frequent travel to high-risk regions, may lead to higher premiums.

By taking care of your health and purchasing a critical illness policy in the right age, you can save a lot on premiums.

How Much Cover Will I Need?

The appropriate level of coverage varies based on personal needs and situations. For example, someone with fewer financial responsibilities may choose a lower coverage amount compared to someone with dependents or significant obligations. It's crucial to carefully evaluate your own circumstances, taking into account present expenses and future goals, to determine the right coverage level for you.

Frequently Asked Questions (FAQs)

Yes, critical illness insurance can cover pre-existing conditions. However, it's crucial to disclose any pre-existing conditions during the application process to ensure proper underwriting.

The appropriate amount of coverage varies based on individual circumstances. Consider what financial burdens you would need covered in the event of critical illness, such as medical expenses or debts, to determine the suitable coverage amount for you.

The application process for critical illness plans differs among insurance providers. While most require disclosure of pre-existing conditions, some may also require medical tests. Your insurance broker will provide guidance on this process during your consultation.

More From Critical Illness

- Recent Articles

- Popular Articles