What is an Insurance Premium: How It’s Calculated

Whether you're buying health, car, or life insurance, understanding how premiums work in the UAE is a key to making smarter financial choices. Your insurance premium is the amount you pay to keep your policy active, but did you know that it is tailored to your profile?

From your age and lifestyle to the type of coverage you choose, several factors influence the cost. For instance, a healthy non-smoker may pay less for life insurance compared to someone with medical conditions - because insurers assess risk before setting a price.

Renewing your car insurance as a resident? You will want to compare policies and avoid overpaying. Exploring health cover options as an expat? Knowing how premiums are calculated can help you choose the best plan.Best Term Insurance Plans in UAE

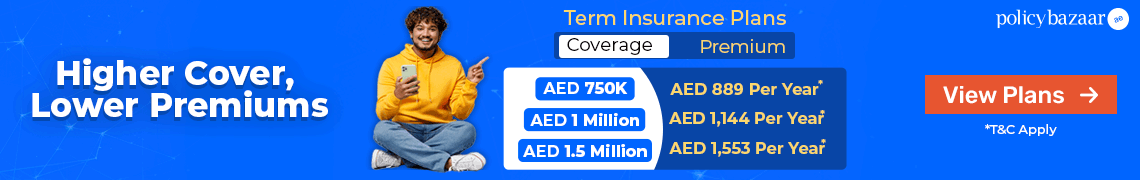

Some of the best Term Insurance quotes in UAE & Dubai are:

What is an Insurance Premium?

An insurance premium is the amount you pay to an insurance company at regular intervals to keep your coverage active. This payment can be made monthly, semi-annually, or as a one-time full payment, depending on the plan and your preference.

What Determines Your Premium?

Insurance companies calculate premiums based on:

✔️The type of coverage you choose

✔️Your age

✔️Health condition (like diabetes or heart disease)

✔️Lifestyle habits (such as smoking)

✔️Where you live, and your job

How Do Insurers Calculate Risks?

Actuaries calculate risks, like the chances of critical illness or accidents, across different age and lifestyle groups. Higher risks usually mean higher premiums. For non-life insurance like car insurance, premiums may go down after a claim-free year or increase after filing a claim.

|

Scenario 1: Sarah, a 30-year old non-smoker is applying for a life insurance policy. She leads a healthy lifestyle with no medical conditions. Because her risk profile is low, her insurance company offers her a lower premium. Scenario 2: Now consider John, a 45 year old smoker with a history of high blood pressure. Since these factors increase the risk, his insurance provider charges a higher premium. |

How Does Insurance Premium Work?

When you purchase an insurance policy, you agree to pay regular premiums to keep your policy active. In return for these payments, the insurance company agrees to provide coverage as outlined in your policy.

Key Points to Understand:

➡️As long as you pay your premiums on time, the insurer will cover any valid claims you make.

➡️If you stop paying the premium, your policy may be cancelled or paused, meaning you won’t be protected in case something unexpected happens. For example, with car insurance, regular payments are needed to stay covered in case of accidents or damage.

➡️The same applies to health insurance—paying your premiums keeps your medical coverage in place, helping you manage healthcare costs when needed.

Insurance Premium Types

Here’s a simplified and detailed explanation of the different types of insurance premiums —

| Type of Insurance Premium | Description |

|---|---|

| Life Insurance Premiums | These premiums are based on factors like age, health, lifestyle, and habits such as smoking or drinking. Risky jobs or hobbies can also increase the premium. Insurers use statistical and medical data to estimate the chances of a claim and set the premium accordingly. It’s important to provide accurate information when applying to avoid future issues. |

| Health Insurance Premiums | In the UAE, many employers pay for employees' health insurance. If you’re paying it yourself, a lower premium may mean higher costs when you need treatment. These premiums depend on your age, existing health conditions, coverage type, deductibles, and copayments. We Recommend: Always choose a plan based on your medical needs and budget. |

| Auto Insurance Premiums | Your driving history affects how much you pay. Drivers with a clean record usually get lower premiums, while those with past accidents, traffic fines, or license issues may pay more. |

| Home Insurance Premiums | Premiums for home insurance depend on the property's age, size, value, and location. Homes in areas prone to natural disasters like floods or storms often have higher premiums. |

How is Insurance Premium Calculated?

Insurance premiums are calculated based on the factors which we have mentioned below.

- Type of Insurance – Different insurance types come with different risks. For example, in car insurance, someone driving in a high-traffic or accident-prone area may pay a higher premium than someone in a safer zone. Similarly, health insurance premiums can vary based on personal health risks.

- Coverage Amount – The more coverage you choose, the higher the cost. A health insurance plan that covers a wide range of treatments and benefits will cost more than a basic plan with limited features.

- Risk Assessment – Insurers evaluate how risky it is to provide you with coverage. For car insurance, this includes your age, driving record, and vehicle type. For health insurance, your age, medical background, and lifestyle (like smoking) are considered.

- Claims History – If you’ve made several insurance claims in the past, your premium may be higher. This is because insurers view frequent claims as a sign of higher future risk.

Things to Consider When Buying an Insurance Policy

When buying an insurance policy, keep these key points in mind to make the right choice —

- Coverage Requirements – Decide what kind of protection you need. For example, a comprehensive car insurance policy offers wider coverage than a basic third-party plan but costs more. Choose based on your needs.

- Affordability of Premium – Make sure the premium is affordable and fits your budget. While more coverage offers better protection, it’s important not to overextend financially.

- Insurer’s Reliability – Select a trusted insurance provider with a strong reputation and high claim settlement record, such as Bajaj Allianz. This ensures quick and fair claim processing.

- Policy Exclusions – Always read the policy exclusions—what isn’t covered—so you’re not caught off guard during a claim.

How to Save Money on Insurance Premiums?

Now that you understand how insurance premiums are calculated, you can use this knowledge to reduce your premium costs.

Here are some practical tips to help lower your payments—

| Tip to Save on Insurance Premiums | Description |

|---|---|

| Avoid Impulsive Purchases | Don’t rush into buying a policy. Take time to compare quotes from different insurance companies. This helps you find better deals and avoid overpaying. |

| Buy Direct from the Insurer | Purchasing your policy directly from the insurance company can save money, as agents often include their commission in the quoted premium. |

| Stick with One Insurance Provider | Using the same company for multiple policies (like health, car, and home insurance) can often get you a discount through bundled offers. |

| Choose a Trusted Insurance Company | Don’t choose a policy just because it’s cheap. Always go with a well-known and highly rated insurer to ensure reliable claim support and good service. |

| Avoid Making Small Claims | Filing frequent small claims (in case of health and auto insurance) can remove your No Claim Bonus (NCB) and lead to higher premiums in the future. Pay for minor damages out-of-pocket when possible to keep your NCB intact. |

More From Term Insurance

- Recent Articles

- Popular Articles

.jpg)