Best Term Insurance for HNIs: Protecting Wealth, Loved Ones, and Legacy

High-net-worth individuals (HNIs) can often face difficulties when it comes to protecting their wealth and ensuring their families’ financial security. Term insurance for high-net-worth individuals can prove a useful option here. It brings various benefits such as instant fund access and estate ...read more

Who is a High Net Worth Individual?

High-net-worth individuals (HNIs) are people or households with liquid assets between $1 million and $5 million. Very-high-net-worth individuals (VHNIs) usually have liquid assets ranging from $5 million to $30 million. The UAE's tax-free environment offers HNIs greater financial freedom, free from many typical governmental or regulatory hurdles.

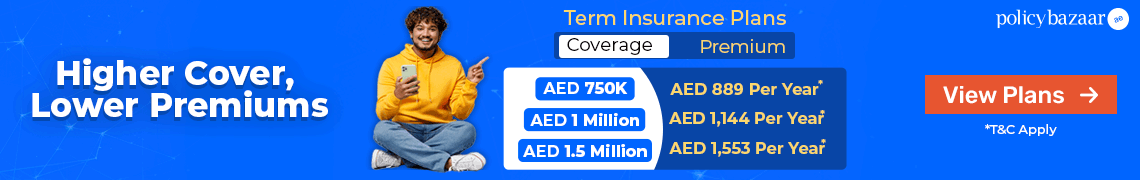

Best Term Insurance Plan in UAE

Some of the best Term Insurance quotes in UAE & Dubai are:

Why Does Term Insurance for High Net-Worth Individuals Matter in UAE?

It’s a common belief that people and celebrities with high net worth usually don’t need term coverage, because they already have sufficient assets. However, HNI term insurance plans go beyond simple coverage. Here are the reasons high-net-worth individuals need term life insurance.

- Instant Fund Access – There is no need to liquidate assets to handle emergencies after the life assured’s death.

- Estate Preservation - The HNI’s legacy or properties remain intact. The sum assured from the term insurance company covers the debts and other financial emergencies.

- Cost-efficient - A term life insurance policy is affordable and tends to offer higher coverage.

What is Term Insurance for High Net-Worth Individuals?

HNI term insurance is specifically designed for individuals with substantial and rare assets who require high-value life insurance coverage. This type of insurance ensures that the wealth, the family’s future, and the estate remain protected even if the HNI passes away untimely.

What sets high-net-worth individuals’ term insurance apart from regular term life policies is their large sum assured options, exclusive underwriting, and flexible policy structuring.

Quick Facts about Term Insurance for High Net-Worth IndividualsHigher Coverage - Get life cover in millions to meet your lifestyle and responsibilities |

|---|

Benefits of HNI Term Insurance You Should Know

Here are the main benefits of high-net-worth individuals' term life insurance -

- Preserves the family’s lifestyle and saves future financial needs

- Reduces the pressure of selling high-value assets or properties

- Get strategic support for succession planning

- Easy to personalise for trusts or key person insurance requirements

- The application is confidential, and priority claim support is available

Best Term Life Insurance Plans for High Net-Worth Individuals in Dubai, UAE

Here are the best term plans for HNIs in the UAE —

- HAYAH Term Life Protect

- MetLife Live Life

- Orient International Term Plan

- Sukoon Life Guard

- LIC Life Protect Term Plan 278

- Zurich International Term Assurance

How Much Coverage Do HNIs Need?

Term insurance coverage for HNIs should ideally be 10 to 15 times their annual income. It helps their family maintain their lifestyle, manage debts, and take care of their estate.

If you’re unable to decide on the amount, Policybazaar.ae is here to help you get the right coverage as per your needs.

Who Needs High Sum Assured Term Insurance UAE?

The HNI term plans in UAE can be bought by —

- C-suite executives

- Professional athletes

- National and international diplomats

- Government officials

- Celebrities

- Business owners and entrepreneurs

- Professional investors

Things to Consider When Buying HNI Term Insurance Plans

Before buying a high-net-worth individual term insurance plan, it’s important to take note of the following —

- Assess Your Requirements - Review your requirements and find a plan accordingly.

- Global Requirements - Ensure that your high-sum assured term insurance in UAE offers international coverage if required.

- Future Adjustments - Look for HNI term life insurance plans that allow policy upgrades or increasing coverage as per the evolving needs.

- Select the Appropriate Cover - Make sure the insurance coverage is adequate to support your family financially. A standard recommendation is to target at least 10 times your annual income.

Wrapping Up

Term insurance for high-net-worth individuals is essential for protecting wealth and ensuring financial security for loved ones. These plans are designed to meet the specific needs of affluent individuals. HNIs can safeguard their legacies and have peace of mind, knowing their families will be supported financially in any situation by selecting the right coverage.

Investing in HNI term insurance is a wise decision for a secure future.

What is term insurance for HNI?

A term policy for HNIs is an efficient way to manage the wealth of high-net-worth individuals in unfortunate circumstances. With high coverage options, it handles debts and emergencies without the need to dig into the estate.

Do wealthy people have life insurance policies?

Yes, several HNIs use life insurance policies to support charitable organisations while preserving their wealth for future generations.

Know More About Other Investment Option

More From Term Insurance

- Recent Articles

- Popular Articles

.jpg)