Short-Term Life Insurance Policy: Coverage, Benefits & Buying Guide UAE

A short term life insurance policy is ideal for situations where you don’t need a long-term or permanent policy. While life plans present a popular way to ensure the financial security of your loved ones, there are certain times when you don’t want a long-term policy. With this option, you can ...read more

What is a Short Term Insurance Plan?

As the name suggests, short term life insurance offers coverage for a limited time, typically from 5 to 10 years or more. Just keep in mind that the coverage can be slightly longer as well — the actual period will depend on your choice, the policy chosen, and many other factors. It is designed to cover the short-term demands of individuals, offering temporary financial protection.

In all other aspects, it’s the same as a standard life plan — your beneficiaries get a death benefit if you pass away in the policy tenure.

(Disclaimer: This page is for information purposes only)

Buy Best Life Insurance Plan in UAE

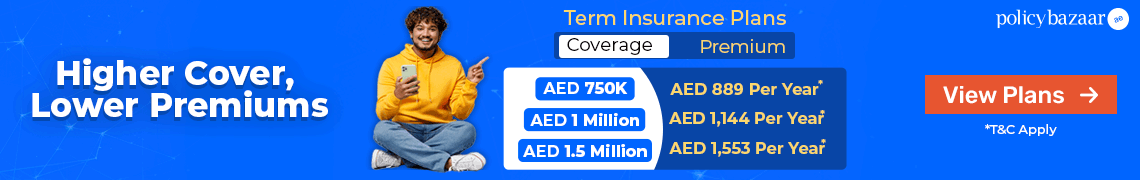

Some of the best Term Insurance quotes in UAE & Dubai are:

Who Needs a Short Term Life Insurance Policy?

Regardless of age and gender, term insurance UAE has become a crucial component for individuals in different phases of life.

In most cases, people take term life plans with coverage of 20-30 years or even more. This is to ensure their family’s security and the fulfilment of their goals, whether in terms of education, children’s marriage, and more. However, if you need life coverage for a short period but don’t want a policy for decades, you can still find an option.

Generally, a short term life policy is ideal for those going through transitional phases in life. It is certainly an excellent option for individuals in the following scenarios —

- Temporarily involved in a job with regular risks

- Repaying a debt that will still last for a few years

- Facing significant health challenges in old age

- Travelling somewhere and seeking coverage against unfortunate events

- About to retire and want to secure financial freedom

- Previous term plan about to lapse

- Working as a salaried employee but wanting to take a short-term break from the job

What Does Short Term Life Insurance Cover?

Here is what a short term insurance plan typically covers —

Death Benefit

Just like a standard plan, a short-term life policy provides a pre-decided amount to your beneficiaries in case of your death in the policy tenure. This amount, called the sum assured, can help your family deal with outstanding debts, daily expenses, costs related to children’s education, and more.

Accidental Death

In case the insured dies due to an accident, this coverage can provide an extra sum assured to the beneficiary on top of the pre-decided sum assured amount.

Terminal Illness

If the insured individual is diagnosed with a terminal disease, the insurance company provides an early payout. This amount is either in addition to the standard death benefit or an accelerated benefit. In the second case, it will be deducted from the final payout received by the beneficiaries after the insured’s death.

Critical Illness

If the insured is diagnosed with a critical illness, this rider pays a lump sum amount. This amount can be used to cover medical treatments, daily expenses, and more.

Just like terminal cover, this rider can also be an additional or an accelerated benefit.

✍️Note: It’s advised to check the inclusions under your chosen plan as the coverage may vary.

Read More: Critical Illness Insurance in UAE

Benefits of Short Term Life Insurance Policy

Here are the key benefits of a short term insurance plan —

Low Premiums

Since a short-term life policy covers your life for a limited period, you can easily get it at low premiums. More affordable than long-term policies, this option is ideal if you are facing any financial difficulties or simply don’t want cover for a long period.

Family Protection

With this type of life coverage, you can ensure that your family or loved ones get sufficient financial support. For instance, if you are nearing retirement and want cover only till the time your pension starts, this policy can do that. Similarly, if you have any debt and want coverage only till its repayment, the plan can do that as well.

Flexibility

This is one of the most significant advantages of short term life insurance policies. You can choose whatever coverage duration you want with the plan — from 5 years to 10 years or even more, depending on your preferences and lifestyle changes.

Availability of Add-Ons

By paying a bit extra, you can add multiple layers of protection with various add-ons. These riders work just like how they do with standard plans. Some of the most common term insurance add-ons include coverage for permanent disability, critical illness, accidental death, and more.

Documents to Buy a Short Term Life Insurance Policy

Here are the documents generally required to buy life insurance for short term —

✅Emirates ID

✅Residential proof

✅Income proof

Note: Additional documents may be required at the insurer’s request.

How to Choose the Best Short Term Life Insurance Policy?

Here are some of the common factors to consider while purchasing a short-term life insurance policy –

🟢Compare term plans from reputed insurers across the UAE — use platforms like Policybazaar.ae to find the best plans from the leading insurers in one place

🟢Evaluate your income, financial liability, and family’s requirements before purchasing a short-term policy

🟢Always check the claim settlement ratio of the insurance provider — this shows you the number of claims settled out of the total claims received

🟢Check the availability of add-ons or riders for extra protection.

🟢Choose an insurance provider with a straightforward claim settlement process and robust customer support

Read More: Life Insurance Claim Settlement Ratio

Where to Buy a Short Term Life Insurance Policy?

Looking to buy the best term life policy? Policybazaar.ae is the right place to find the best coverage at the most affordable rates.

Here’s how to start your journey —

➡️Click here to find the form to get started

➡️Fill it out — this will require your name, contact details, income details, age, and more.

➡️Submit the form and get to the quotes page

➡️Use the relevant filter to choose short-term plans

➡️Compare the top plans

➡️Hit the ‘Apply’ button by choosing a suitable plan

Frequently Asked Questions

What does short-term insurance cover?

A short term insurance plan covers you for a limited period — usually 5 to 10 years or more. In case of your death, it offers financial support to nominees or beneficiaries through a sum assured (death benefit).

How does short-term life insurance differ from regular term insurance?

Short-term life plans work just like regular term plans. The only difference is in the policy tenure — short-term plans have a coverage period of 5 to 10 years while regular plans are usually taken for 20-25 years.

Can I buy a short term insurance plan online in the UAE?

Yes, you can easily get short term life cover online through websites like Policybazaar.ae. This platform allows you to compare different plans from the top providers, giving you an opportunity to choose the best.

Can I get short-term life insurance without a medical exam?

The requirement for a medical examination for life coverage in the UAE depends on the insurer. Generally, a checkup is required for older individuals or those who smoke regularly. It’s advisable to check the requirements before buying a plan.

Know More About Other Investment Option

More From Term Insurance

- Recent Articles

- Popular Articles

.jpg)