- What is Travel Insurance?

- Travel Insurance UAE at Glance

- When to Purchase Travel Insurance?

- Who Should Buy Travel Insurance?

- Importance of Travel Insurance

- Buy Travel Insurance Online in 5 Steps:

- What Is Covered and Not Covered in Travel Insurance Dubai?

- Documents Required for Travel Insurance

- How Does Policybazaar.ae Help You Buy the Right Travel Insurance Online?

- Countries that Require Mandatory Travel Insurance

- Know More About Travel Insurance

- You May Also Check

Travel Insurance

Travel insurance is a unique product meant to protect you while traveling it offers you financial help in case something were to go wrong while you’re traveling. It is essential to buy insurance to protect your travel because it can provide peace of mind in the event of any unexpected issues that ...read more

Best Travel Insurance Plans in UAE

Protect Your Travel with Top Plans

What is Travel Insurance?

Travel insurance is a special kind of insurance that financially helps you when you are travelling. It's like a safety net that saves you if something unexpected happens and costs a lot of money.

Imagine you're on a trip and your bags get lost, you need to see a doctor urgently, your flight gets cancelled, or you're stuck somewhere because of a delay.

It can cover the money that you'd lose in these situations. Some places that you visit might even require mandatory insurance so that you don't end up in a tough spot if there's an emergency.

However, even if it's not required, having insurance is a smart choice. Remember — having the right insurance can turn a potential disaster into a minor hiccup, and you can enjoy your journey with peace of mind.

Travel Insurance UAE at Glance

| Particulars | Specification |

|---|---|

| Insurance Cost | Starting at AED 22 |

| Age Range Covered Under the Insurance | From 30 days to 65 years |

| Countries Covered | 200+ Countries covered |

| Duration of Insurance | Single trip: A trip of upto 90 days or upto the return date (which ever is earlier) Multi trip: Valid up to 1 year with a maximum coverage of up to 90 days per trip |

| Medical Benefits |

|

| Add-ons |

|

| Covers Family | Available with most plans |

| Claim procedure | Can Claim both online and offline |

| Claim Settlement Preiod | Depends on the insurance provider but typically within a few weeks |

| Customer Support | Possible in case of travel delay, with the insurer's approval |

| Policy Extension | Possible in case of travel delay, with the insurer's approval |

| Cancellation Policy | Free cancellation within a specific period, varies by insurer |

When to Purchase Travel Insurance?

The best time to purchase travel insurance is ideally within 14 days of booking your journey. This timing allows you to take full advantage of the policy's benefits, including those that may require early purchase such as coverage for pre-existing conditions or cancel-for-any-reason options.

Who Should Buy Travel Insurance?

Tourists

Students

Families

Senior Citizens

Businesses

Tourists can purchase either an individual or group plan. Individual travel insurance plans offer benefits like emergency medical coverage, trip-related and baggage-related coverage, and more. Tourists travelling in groups, on the other hand, can secure a group travel plan. However, there is a limit on the number of members covered under such plans.

Generally, students between 16 and 35 years of age who go on education trips or pursue higher studies abroad should also secure a plan. These insurance plans provide a combination of medical insurance and travel benefits. The limit for such a insurance plan is between 30 and 45 days.

Families can also take a insurance plan while travelling abroad. Such insurance plans usually include all the members of the family right from a 30-day infant to a 65-year-old adult. The upper age limit for members in the plans, however, differs from provider to provider.

The options for insurance online also include plans specifically made for senior citizens. These travelling insurance plans are designed for people who are more than 65 to 70 years old. The minimum and maximum age for the plan could differ depending on the provider. Some providers have set an upper limit for the age of 99 years, while others have set the maximum limit at 80 or 85 years. The plans available for senior citizens are usually more expensive than other plans.

Business owners can secure a business travel insurance plan for their employees who have to travel abroad for work. Any employee travelling for business can secure the plan only at the company’s discretion. These plans are similar to individual insurance plans except for their additional covers like cover for electronic gadgets.

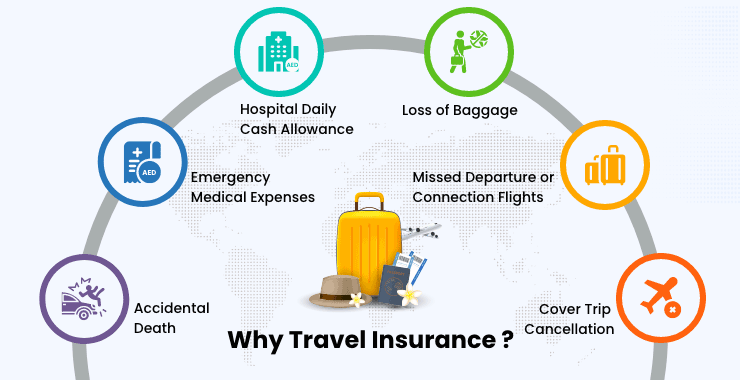

Importance of Travel Insurance

| Type of Plan | Description | Eligibility | Apply |

|---|---|---|---|

| Individual Plan | Individual travel insurance is tailored for solo travellers | Individual travellers; No specific age restrictions but varies by provider | Buy Now |

| Senior Citizen Plan | This insurance provides coverage with a focus on medical care, including pre-existing conditions for seniors aged above 65 |

For travellers aged 65 years and above |

Buy Now |

| Family Plan | Offering bundled coverage for the entire family, this insurance simplifies protection for all family members traveling together. It's ideal for families seeking a unified policy that covers everyone. | Families traveling together: May require at least one adult and one child | Buy Now |

| Schengen Visa Plan | Specifically required for visa applications to the Schengen area, this insurance meets the visa requirements and covers medical expenses and repatriation. | Travelers visiting Schengen area — must meet Schengen visa insurance requirements | Buy Now |

| Business Plan | Designed for professional needs, this insurance covers trip cancellations, lost business equipment, and medical emergencies. | Employed and traveling for work purposes; company may specify eligibility | Buy Now |

| Student Plan | Tailored for students studying abroad, this type of insurance covers health, personal belongings, and travel interruptions, often including coverage for study-related needs. | Students studying abroad — age limits may apply, usually between 16 to 35 years | Buy Now |

| Group Plan | When traveling in groups, this insurance offers a cost-effective way to cover all members under one policy. | Groups of travellers — minimum group size may be required | Buy Now |

| Domestic Plan | This type of insurance covers trips within your home country. | Resident of the country where the policy is purchased | Buy Now |

| International Plan | Tailored for trips abroad, this insurance offers wide coverage. It's a must-have for anyone traveling outside their home country as it provides global protection. | Must be traveling outside your home country | Buy Now |

| Single Trip Plan | Designed for one-off trips, this insurance covers you from the moment you leave your home until you return. It's perfect for occasional travellers who require coverage for a specific journey. | Available for one specific trip — no age restrictions but varies by provider | Buy Now |

| Multi-Trip Plan | This insurance is for travellers who take multiple trips in a year, providing coverage for all trips within a set period (usually 12 months). Frequent travellers can benefit from this convenient and cost-effective option. | Frequent travellers: Some insurers may have age limits. | Buy Now |

Buy Travel Insurance Online in 5 Steps:

What Is Covered and Not Covered in Travel Insurance Dubai?

What it Covers?

What it doesn't cover?

Although the coverage of travelling insurance plans varies from one plan to another, some inclusions remain consistent across most policies. Generally, the insurance plan includes the following:

- Emergency Medical Coverage: If you suddenly fall ill or get injured during your trip, travel insurance provides you with medical emergency coverage. This covers all the expenses related to hospitalisation, treatment, and more.

- Trip Cancellation & Curtailment: You can get reimbursement for non-refundable expenses, such as flights and hotel bookings. This coverage can be claimed if your trip gets cancelled or cut short due to illness, death in the family, natural disaster, weather conditions, and more.

- Medical Evacuation & Repatriation: The travel policy covers the cost of transportation to the nearest hospital or back to the home country in case of sudden illness or accident.

-

Luggage Loss & Damage: Get financial protection in case of baggage loss, damage, or theft during the trip. Under this coverage, you can get compensated by the insurer for the checked-in items by the airline.

-

Personal Liability: Protects you financially if you unintentionally injure or damage someone or someone’s property while travelling. It covers legal expenses and compensation for the damage or loss.

Pre-Existing Medical Conditions: Health issues arising during the covered trip due to pre-existing medical conditions are not covered in a travel insurance plan in the UAE.

Life-Threatening Adventurous Sports: Adventurous activities in which high risk is involved are not generally covered under a travel plan in Dubai. Skydiving, scuba diving, mountaineering, motor racing, and more are some of the common sport activities.

Travel Against Medical Advice: You cannot claim travel insurance if you are travelling against the doctor’s advice.

Drug and Alcohol Intoxication: Any claims resulting from accidents, injuries, health issues, or more due to the influence of drugs and alcohol are excluded under the travel policy.

War & Terrorism: Damages or injuries due to war, civil unrest, or terrorist activities are excluded under a standard travel insurance policy.

Documents Required for Travel Insurance

When applying for insurance, it's essential to have all the necessary documents ready for a smooth and efficient process. Here's a list of the common documents required:

- Completed application form

- Passport copy

- Visa copy (if applicable)

- Travel itinerary

- Flight tickets

- Proof of accommodation (like hotel bookings)

- Identification proof (such as a national ID card)

- Proof of payment for the trip (receipts, credit card statements, and so on)

- Recent passport-size photographs

- Any other document requested by the insurance provider

Note: This list can vary depending on the insurance company and the type of insurance you're applying for. For this reason, it's always a good idea to check with your specific provider for any additional requirements.

How Does Policybazaar.ae Help You Buy the Right Travel Insurance Online?

When looking for the best Travel insurance online, it's important to choose a platform that offers a seamless process and allows you to compare various top insurance plans.

One such platform is Policybazaar UAE, which simplifies the process of finding and purchasing insurance that suits your travelling needs. When you buy insurance from Policybazaar UAE, you get to enjoy several advantages:

- Convenience: Policybazaar.ae makes it easy to browse and compare different plans from the comfort of your home or office.

- Time-Saving: The platform allows you to quickly compare the features, benefits, and prices of various policies.

- Customisation: With Policybazaar UAE, you can tailor your policy according to your specific travel needs.

- Paperless Process: The entire process — from comparing plans to purchasing your chosen plan is digital. This makes it efficient and environmentally friendly.

- Top Insurance Plans Availability: Policybazaar UAE provides access to a wide range of insurance plans from leading insurance providers. It gives you the opportunity to choose the best and cheap travel insurance options available in the market.

- Customer Support: Excellent customer service is available to help you understand different policies, clarify doubts, and assist you in the claim process, if necessary.

Countries that Require Mandatory Travel Insurance

Although insurance is an optional choice for travellers and tourists generally, there are a few countries that have made it mandatory to have travel itif you want to visit. UAE is one of these countries as well. Following is a complete list of all the countries that require you to have itapart from the UAE :

|

|

|

Note that the conditions and insurance required for each country are always slightly different. For example, the travel insurance for the Schengen group must be a minimum of €30,000. Make sure that you get familiar with all the terms and condition before you invest in a plan.

Travel Insurance - FAQs

- General

- Coverage

- Premium

You May Also Check

| Health Insurance | Car Insurance | Term Insurance | Life Insurance |

Travel Insurers

More From Travel Insurance

- Recent Articles

- Popular Articles