Why Choose PB Advantage for Your Health Insurance?

PB Advantage is transforming the way people experience insurance in the UAE. With the soaring costs of services and the growing need for simplicity, efficiency, and customer-centric solutions, PB Advantage focuses on addressing common challenges faced by policyholders. This initiative introduces ...read more

What is PB Advantage?

The PB Advantage is a pioneering initiative by Policybazaar.ae that is transforming the experience of insurance in the UAE. Built with a deep understanding of customer needs, PB Advantage addresses the most common challenges faced by policyholders such as lengthy claims processes, limited coverage flexibility, and insufficient support for unique requirements.

With a focus on resolving these pain points, PB Advantage offers a seamless, efficient, and rewarding insurance experience — to both UAE residents and NRIs.

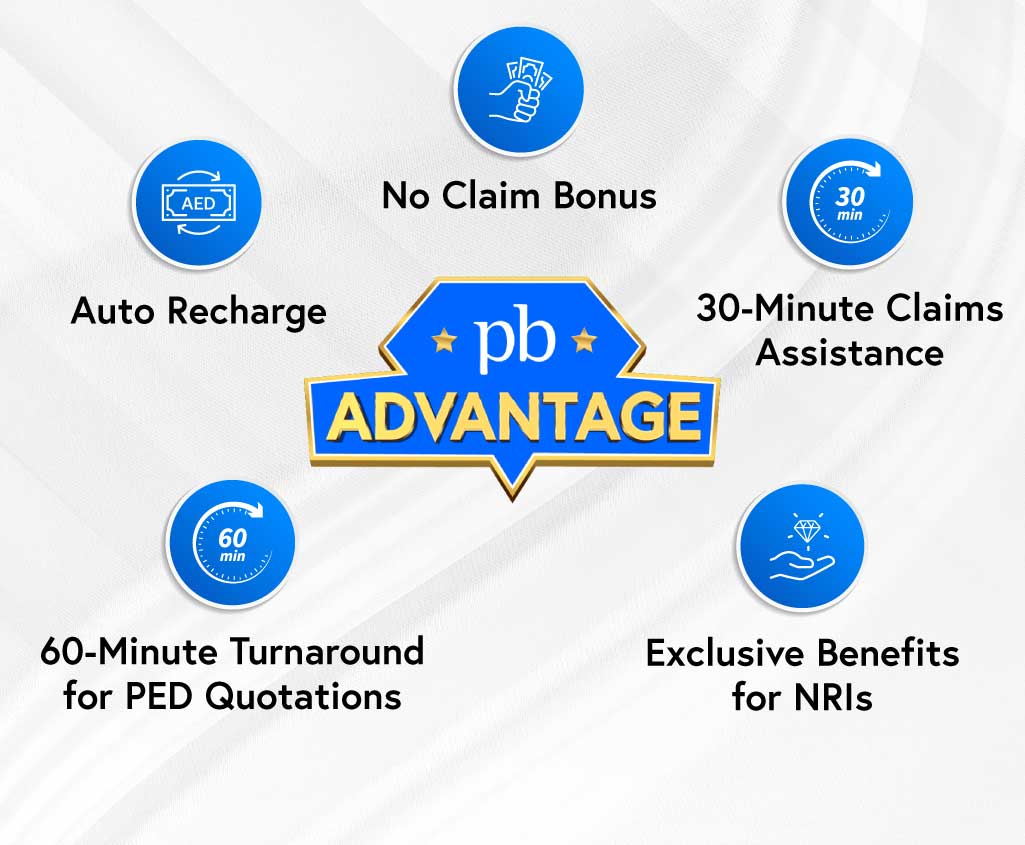

Benefits of Buying Health Insurance with PB Advantage

Here are the benefits under PB Advantage you can enjoy when you buy health insurance from Policybazaar.ae —

PB Advantage for UAE Residents

30-Minute Claims Assistance:

Dealing with claims can be stressful, but with PB Advantage, help is always just 30 minutes away. Our dedicated claims management team ensures that your queries are addressed promptly and your concerns are resolved without unnecessary delays. For example, if you’ve just undergone a medical procedure and need assistance with the claims process, our team will guide you quickly so you can focus on your recovery.

Auto Recharge:

Imagine exhausting your policy’s sum insured after a major surgery.

What happens next?

With the auto recharge benefit, your sum insured is automatically reinstated once per policy year, giving you an additional amount equivalent to your original coverage. For instance, if your initial sum insured is AED 500,000 and you use it for a critical illness, the auto recharge feature provides another AED 500,000 for any new, unrelated medical condition.

However, note that this benefit cannot be used for pre-existing conditions or maternity claims.

No Claim Bonus:

PB Advantage rewards you for staying claim-free with a unique No Claim Bonus. For every claim-free year, your sum insured increases by 10%, up to a maximum of 50%.

For example, if your original coverage is AED 1 million and you don’t make any inpatient claims for five consecutive years, your coverage grows to AED 1.5 million. Even if you make a claim, the increased amount will only reduce by 10% and will never fall below your original sum insured.

60-Minute Turnaround Time for Pre-Existing Condition Quotations:

We ensure that you get a quick response for pre-existing condition quotations within just 60 minutes. This PB Advantage feature saves you valuable time and helps you make informed decisions regarding your health insurance coverage without any hiccups.

PB Advantage for NRIs

- Free Annual Health Check-Up in India: Staying proactive about your health has never been easier. PB Advantage offers all insured individuals a cashless annual health check-up in India, available once per policy year. For example, if you’re visiting India to spend time with your family, you can schedule your free check-up and prioritise preventive care without additional expenses.

- Cashless In-Patient Claims in India: Hospitalisation in India can be financially stressful, but PB Advantage provides cashless in-patient services in network hospitals across 400 cities. Whether you’re admitted for a planned procedure or an emergency, your bills are directly settled with the hospital, eliminating the need for upfront payments. The claim processing follows the same terms and conditions as your UAE policy.

- Pre-Existing Condition Quotes in Under 60 Minutes: Typically, getting health insurance quotes for pre-existing conditions can take up to 48 hours. PB Advantage changes this by bringing accurate quotes to you within just 60 minutes.

- One Comprehensive Plan for UAE and India: Managing multiple health insurance policies across countries can be challenging. With PB Advantage, you get a single plan offering comprehensive coverage in both the UAE and India. So, if you’re working in Dubai or visiting family in India, your medical insurance has you covered.

- Policy Portability to India: If you’ve maintained continuous health insurance coverage in the UAE for 4 years, PB Advantage allows you to transfer your policy benefits to India without losing accrued advantages. This includes crediting the waiting periods for named ailments and pre-existing conditions. To understand instance, if you’ve already completed the waiting period for a pre-existing condition like diabetes in the UAE, you won’t need to start over when moving to an Indian policy.

- 30-Minute Claims Assistance: Just like UAE residents, NRIs can also enjoy the benefit of quick claims assistance within 30 minutes, no matter where they are.

Health Insurance Plans with PB Advantage Benefit

Policybazaar.ae partners with leading insurance providers in the UAE to offer health insurance plans enhanced by the PB Advantage. These plans are tailored to provide exclusive benefits, such as faster claims processing, additional coverage options, and cross-border conveniences for NRIs.

Here is a detailed overview of insurance companies, their associated TPAs (Third-Party Administrators), and the programs available under PB Advantage —

|

Insurance Company |

TPA |

|---|---|

|

Dubai Insurance |

Mednet, Dubai Care, Carenext, Ecare, Mednet NRI Care, Dubai Care - NRI, Carenext NRI |

|

Watania |

NAS, NAS - NRI Care |

|

Hayah |

Nextcare |

Explanation of Key Terms

- Insurance Company: Providers offering health insurance plans improved with PB Advantage benefits

- TPA (Third-Party Administrator): The organisation responsible for claims processing and customer support for specific insurance providers

How to Buy PB Advantage Health Insurance Plan?

Buying health insurance through Policybazaar.ae is not only a quick and straightforward process but also lets you enjoy all the exclusive benefits of the PB Advantage. Follow the steps below to get started —

- Access the Health Insurance Section: Click on the health insurance option and fill out the lead form with your details.

- View Insurance Plans: Once you’re on the health insurance quotes page, you’ll see a list of plans. Plans offering PB Advantage benefits will be clearly marked with a special sign, as shown in the screenshot below.

3. Choose Your Plan: Select the health insurance plan that suits your needs, click on it and follow the instructions to complete the process.

Get your health insurance plan today and enjoy the PB Advantage benefits!

More From Health Insurance

- Recent Articles

- Popular Articles

.jpg)