Arabia Insurance - Female Cancer Cover

Cancer is a major health concern globally, including in the UAE. In 2022, the country reported around 5,526 new cancer cases — 2,607 men and 2,919 females. For females, in particular, the leading cancers include breast, thyroid, and colorectal cancers.

While some cancer types are usually treatable in early stages, the treatment and recovery time presents not only physical and emotional challenges but also a substantial financial burden. Cancer treatment costs can escalate quickly— involving everything from diagnostic testing and surgery to chemotherapy and aftercare. This, in turn, has led to an increasing need for a financial safety net.

That's where the Arabia Insurance Company or AIC Female Cancer Cover plan comes in. As a protection plan, it offers essential support to help you manage the financial burden and ensure that a cancer diagnosis won’t deplete your life savings.

Why Choose AIC Female Cancer Cover?

Established in 1944, Arabia Insurance Company (AIC) has built a reputation for reliability across 8 Arab countries. With over 80 years of expertise and an impressive AM Best Financial Strength Rating of B+ (Good), AIC has established itself as a trusted name in the UAE insurance market.

With Arabia Insurance critical illness insurance cover, you can get financial support during difficult times caused by a range of conditions. With lower upfront costs, this insurance plan is a smart choice for women Additionally, it serves as a cost-effective way to secure the future well-being of those you care about.

What are the Benefits of AIC Cancer Protection Plan?

The Arabia Insurance Female Cancer Cover provides you with the following benefits —

- Affordable Premiums: Designed to fit your budget, this plan ensures comprehensive financial protection against critical illness.

Tip💡: Usually, the earlier you purchase, the lower your premium. - Maximum Sum Assured: The sum insured under the AIC Female Cancer Cover can go up to $60,000 (~AED 220,000), providing substantial financial support when needed.

- Easy Application Process: With only two questions on the application, onboarding is quick and straightforward.

- Lump Sum Payout: You can expect a one-time lump sum payout upon early-stage diagnosis. This sum can be used to cover your treatment, day-to-day expenses, existing financial obligations, and more.

- Renewability: The policy guarantees renewal for 5 years without requiring a medical test, simplifying continued coverage.

- Worldwide Coverage: The coverage of this Arabia Insurance policy is valid worldwide. You can enjoy peace of mind, knowing that you are protected wherever you go.

- Swift Processing: The AIC Female Cancer Cover claim process is quick. This lets you focus on what matters most — your health — without worrying about the financial impact.

- Coverage for 8 Types of Cancer: This policy covers 8 types of female cancers, including breast cancer, cervix cancer, and more that we will cover in upcoming sections.

When to Purchase the AIC Cancer Protection Plan?

Purchasing a cancer protection plan at a younger age can lead to more benefits. Early enrollment locks in lower premiums and broader coverage options, securing your financial future. Delaying your purchase could lead to higher premiums and increased financial stress down the road.

Who Should Buy the AIC Female Cancer Policy?

The cancer protection plan is ideal for all women, particularly those with the following situations —

- Dependents: If your income supports loved ones, the AIC female cancer cover can ensure their financial stability during your illness.

- Limited Savings: If your financial resources are limited, a cancer protection plan serves as a safety net for medical expenses and quality of life.

| IMPORTANT |

|---|

|

Some comprehensive health insurance policies may cover expenses related to cancer. However, there may be a few problems with that —

The lump sum amount of the AIC Female Cancer Cover, however, can help you easily navigate past these challenges. The amount can be used not only to cover medical costs but also daily living expenses, debts, and more. |

Types of Female Cancer Covered

AIC Female Cancer Cover provides financial protection against various types of female cancers, including —

- Breast Cancer: Affects breast tissue and is one of the most common cancers in women

- Cervical Cancer: Develops in the cervix and is often linked to human papillomavirus (HPV)

- Uterine Cancer: Occurs in the lining of the uterus and may cause unusual bleeding

- Vaginal Cancer: A rare form, it affects the vaginal walls

- Ovarian Cancer: Arises in the ovaries and may present vague symptoms until advanced stages

- Vulvar Cancer: Affects the outer female genitalia — usual symptoms may include itching or pain on the vulva

- Fallopian Tube Cancer/Tubal Cancer: Rare cancer affecting the tubes connecting the ovaries and uterus

- Placenta Cancer (Choriocarcinoma): Extremely rare, occurring in the tissue that forms the placenta during pregnancy

Eligibility of AIC Female Cancer Cover Plan

To apply for the Cancer Protection Plan, you may need to meet the following eligibility criteria —

| Criteria | Details |

|---|---|

| Minimum Age | 18 Years |

| Maximum Age | 60 Years |

How to Apply for the AIC Female Cancer Cover?

Follow these steps to easily apply for Arabia Insurance Female Cancer Cover with Policybazaar UAE —

- On Policybazaar.ae, select ‘Critical Illness Insurance’.

- Fill out the form to get suitable critical illness quotes.

- Apply for the ‘Arabia Insurance Female Cancer Cover’.

- One of our agents will connect with you soon and discuss the further steps!

Frequently Asked Questions

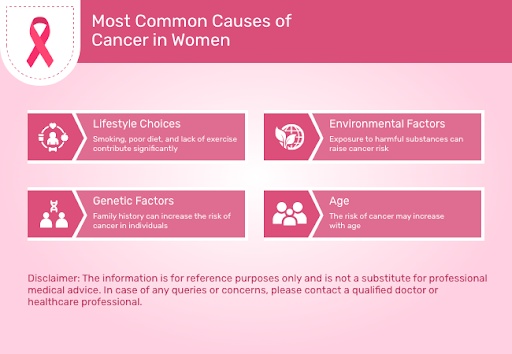

What cancers are common in females?

The most common cancers among women include breast cancer, colorectal cancer, cervical cancer, lung cancer, ovarian cancer, endometrial cancer, skin cancer, and so on.

Which cancer has the highest mortality rate in women in the UAE?

Breast cancer was the leading cause of cancer-related female deaths in the UAE, resulting in around 253 fatalities in 2022.

Is cervical cancer covered in the AIC cancer protection plan?

Yes, cervical cancer is covered under this plan.

What is the coverage limit for cancer treatment under this plan?

There is no specific limit for medical treatments — you get a lump sum amount of up to USD 60,000 on early detection of the disease. You can use this amount to cover your treatments, financial obligations, and more.

More From Critical Illness

- Recent Articles

- Popular Articles